404!

Nothing was found at this location. Try searching, or check out the links below.

Featured Products

-

1-phase Inverters, Other Solar Parts, Solar Inverters/ Chargers, Solar Panels & Controllers

Sunrox Hybrid Solar Inverter TL 6KW

-34% 1-phase Inverters, Other Solar Parts, Solar Inverters/ Chargers, Solar Panels & Controllers

1-phase Inverters, Other Solar Parts, Solar Inverters/ Chargers, Solar Panels & ControllersSunrox Hybrid Solar Inverter TL 6KW

Key Features

-

-

Paralleling Capability: Connect up to 6 units for increased power output.

-

Smart Power Sharing: Reduces utility bills by optimizing power usage.

-

Battery Flexibility: Operates with or without batteries; compatible with Lithium and Lead Acid batteries.

-

Advanced BMS Charging: Smart charging and monitoring for Lithium Ion batteries.

-

Built-in Connectivity: WiFi & Bluetooth for smart monitoring via mobile devices.

-

Dual Output: Separate outputs for Smart and Critical Load management.

-

PV Input: Supports up to 7,000 Watts.

-

Colorful Display: 5-inch LCD with RGB display for easy monitoring.

-

Pure Sine Wave Output: Ensures clean and stable power.

-

Comprehensive Communication: RS232, CAN, and RS485 interfaces.

-

Versatile Operation: Compatible with both ON and OFF grid systems.

-

SKU: TL-Hybrid-6KW -

-

1-phase Inverters, Arduino Boards & Components, Capacitors, i) Resistor, Capacitor, Inductor, Transistor etc., Solar Inverters/ Chargers

Aluminum Electrolytic Capacitor 470UF/450V 30x45mm

-55% 1-phase Inverters, Arduino Boards & Components, Capacitors, i) Resistor, Capacitor, Inductor, Transistor etc., Solar Inverters/ Chargers

1-phase Inverters, Arduino Boards & Components, Capacitors, i) Resistor, Capacitor, Inductor, Transistor etc., Solar Inverters/ ChargersAluminum Electrolytic Capacitor 470UF/450V 30x45mm

Key Features

- Built to the toughest international standards for capacitors

- Colors may vary slightly due to different monitors and different photo shooting conditions.

- Photo does not show the actual size. See the description for size details.

- Marker code on every electrolytic capacitor, and with a lable mark capacitor value, easy to distinguish

- Compact, lightweight, and highly reliable capacitor

SKU: n/a -

1-phase Inverters, Other Solar Parts, Solar Inverters/ Chargers, Solar Panels & Controllers

7KW Solar Inverter – Pure Sine Wave Output

-58% 1-phase Inverters, Other Solar Parts, Solar Inverters/ Chargers, Solar Panels & Controllers

1-phase Inverters, Other Solar Parts, Solar Inverters/ Chargers, Solar Panels & Controllers7KW Solar Inverter – Pure Sine Wave Output

Key Features

-

- High Load Capacity: Can operate up to 7KW load (e.g., 2 ACs of 1.5 tons each, a fridge, refrigerator, water pump, TV, 10 energy savers, 3 fans)

- Pure Sine Wave: Ensures smooth and reliable power output

- Flexible Solar Panel Compatibility: Can work with a minimum of 4 solar panels (585W each) to a maximum of 14 solar panels (585W each)

- Battery-less Operation: Efficiently runs without a battery

- Microcontroller Based: Enhances precision and reliability

- Designed with Super High-Quality and High-Efficiency Components: Ensures longevity and superior performance

- User-Friendly LCD Display: Shows PV voltage, output voltage, running current, voltage, frequency, etc.

- Low Installation Cost: Cost-effective setup

- Easy Installation: Hassle-free setup process

- Low-Cost Repairs: Affordable maintenance and repair costs

- Only an?additional metal box with a fan and on/off switch is required.

- Front Panel with Configuration and Monitoring Buttons: Allows easy configuration and monitoring of inverter parameters

- Designed and Assembled in China: Built on high-quality PCB from the hi-tech industry of China

- Affordable and Accessible: High-quality performance at a reasonable price

- WAPDA Sharing Capability: Possible by adding two high-quality bridges (minimum 100A/100V capacity) inside or outside the box

SKU: n/a -

Product Categories

Popular Products

-

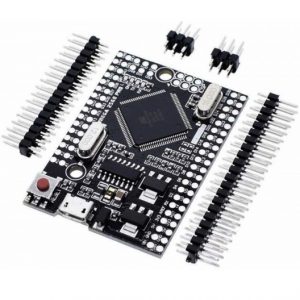

Arduino, Arduino Boards & Components, Development Kits

Arduino MEGA 2560 PRO Mini

Key Features

- Item type:MEGA 2560 Pro Embedded USB CH340G ATMEGA2560-16AU Chip

- Form factor-Mega PRO

- Microcontroller-ATmega 2560 (16 MHz)

- USB-UART-CH340G interface (12 MHz)

- input voltage-6-9 V (peack 18 V)

- PC-MicroUSB connection socket

- 70 digital I / O

- 16 analog entries

- 14 PWM

- 4 UART bus

- Click Here to Download Open Source Arduino Software

SKU: n/a -

Arduino, Arduino Boards & Components, Development Kits

Arduino Uno R3 SMD with USB Cable

Key Features

- The operating voltage is 5V

- The recommended input voltage will range from 7v to 12V

- The input voltage ranges from 6v to 20V

- Digital input/output pins are 14

- Analog i/p pins are 6

- DC Current for each input/output pin is 40 mA

- DC Current for 3.3V Pin is 50 mA

- Flash Memory is 32 KB

- SRAM is 2 KB

- EEPROM is 1 KB

- CLK Speed is 16 MHz

- Click Here to Download Open Source Arduino Software

SKU: n/a -

Arduino, Arduino Boards & Components, Development Kits

Arduino Nano

Key Features

- MICROCONTROLLER: ATmega328

- ARCHITECTURE: AVR

- OPERATING VOLTAGE: 5 V

- FLASH MEMORY: 32 KB of which 2 KB used by bootloader

- SRAM: 2 KB

- CLOCK SPEED: 16 MHz

- ANALOG IN PINS: 8

- EEPROM: 1 KB

- DC CURRENT PER I/O PINS: 40 mA (I/O Pins)

- INPUT VOLTAGE: 7-12 V

- DIGITAL I/O PINS: 22 (6 of which are PWM)

- PWM OUTPUT: 6

- POWER CONSUMPTION: 19 mA

- PCB SIZE: 18 x 45 mm

- WEIGHT: 7 g

- Click Here to Download Open Source Arduino Software

SKU: n/a